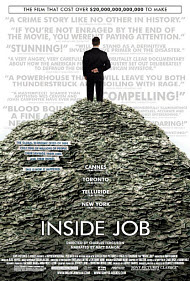

Inside Job

for some drug and sex-related material.

for some drug and sex-related material.

Reviewed by: Cornelius Christian

CONTRIBUTOR

| Moral Rating: | Better than Average |

| Moviemaking Quality: |

|

| Primary Audience: | Adults Teens |

| Genre: | Documentary |

| Length: | 2 hr. |

| Year of Release: | 2010 |

| USA Release: |

October 1, 2010 (festival) October 8, 2010 (NYC) |

| Featuring |

|---|

|

Matt Damon (Narrator) see complete list of people who appear in this documentary, including biographical information |

| Director |

|

Charles Ferguson — No End in Sight (2007) See all info » |

| Producer |

|

Representational Pictures Sony Pictures Classics Charles Ferguson … producer Jeffrey Lurie … executive producer Kalyanee Mam … associate producer Audrey Marrs … producer Anna Moot-Levin … associate producer Christina Weiss Lurie … executive producer |

| Distributor |

“The global economic crisis of 2008 cost tens of millions of people their savings, their jobs, and their homes. This is how it happened.”

“Inside Job” is an incredible film that deserved its Academy Award. It builds tension like a thriller, only to finish without a dénouement, leaving the audience with sole responsibility for a fulfilling conclusion. This is made all the more unsettling by the fact that this is not an action movie; this is real life. I left the cinema burning with righteous indignation against government, academia, and especially the financial industry.

The documentary traces the history leading up to the financial crisis of 2008, and how policymakers and businesses have reacted to it since. The film is not partisan, and both Republicans and Democrats stand accused of allowing unwise deregulation to occur under their watch, which freed the feral beasts of financial liberalization.

There are flaws, of course. Congressman Barney Frank is portrayed positively, even though he denied time and again that Fannie Mae and Freddie Mac were in awful fiscal shape. I wish Frank were given more of a grilling, like the ones Frederic S. Mishkin, Glenn Hubbard and John Campbell received; it was intriguing to watch such esteemed economists being reduced to stuttering buffoons. These men are indubitably brilliant—as an economics student I have read their papers—but used their faculties for evil by giving misleading and/or ingratiating advice to governments and financiers.

Indeed, I wondered why a lot of the movie’s key players—executives, academics, regulators—weren’t imprisoned or at least sanctioned. I suppose the answer lies in former Greenlining Institute director Robert Gnaizda’s statement, that this is a “Wall Street government.” And that’s perhaps the saddest aspect of the movie: it leaves you with an overwhelming sense of defeat, the feeling that drastic and radical measures would have to be implemented to cleanse Wall Street avarice and the harm it has inflicted—and that nobody is willing to implement them.

In this sense, ‘Inside Job’ is a solid reminder that we Christians should guard ourselves against greed, and—if we are blessed to live in a democracy—should use our voices and activism to influence the system for the good of humanity.

There is nothing overly objectionable about the movie. The lives of the financial elite are briefly presented as base and immoral: drug use and prostitution stand out. For this reason, the movie is not suitable for young children.

I recommend this film especially to Americans. These are hard times we’re living in… I just pray that the United States will recover, and become a better country because of it.

Violence: None / Profanity: Minor / Sex/Nudity: Mild

See list of Relevant Issues—questions-and-answers.

about the director—Charles Ferguson

Charles Ferguson, the founder of Representational Pictures and the director of Inside Job, is a filmmaker, writer, and political scientist. A native of San Francisco, California, Ferguson obtained a B.A. in mathematics from the University of California, Berkeley in 1978 and a Ph.D. in political science from M.I.T. in 1989. Following his Ph.D., Ferguson was a postdoctoral researcher at M.I.T. for three years, focusing on interactions between high technology, globalization, and government policy, and frequently consulting to U.S. government agencies including the White House staff, the Defense Department, and the U.S. Trade Representative. Then from 1992 to 1994 Ferguson was an independent consultant to high technology companies including Apple, Xerox, Motorola, Intel, and Texas Instruments. In 1994 Ferguson founded Vermeer Technologies, a software company which developed FrontPage, the first end-user Web site development tool, which he sold to Microsoft in 1996. Subsequently he spent several years as a Senior Fellow at the Brookings Institution and a visiting scholar at M.I.T. and U.C., Berkeley.

In mid-2005, Ferguson formed Representational Pictures and began production of his first film, “No End In Sight: The American Occupation of Iraq,” which premiered at the Sundance Festival in 2007. “No End In Sight” won the Special Jury Prize at Sundance, the Best Documentary prizes of the New York and Los Angeles Film Critics circles, and was nominated for an Academy Award for Best Documentary. Ferguson has authored several books including High Stakes, No Prisoners: A Winner’s Tale of Greed and Glory in the Internet Wars, and Computer Wars: The Post-IBM World (co-authored with Charles Morris).

Director’s statement—“This film attempts to provide a comprehensive portrayal of an extremely important and timely subject: the worst financial crisis since the Depression, which continues to haunt us via Europe’s debt problems and global financial instability. It was a completely avoidable crisis; indeed for 40 years after the reforms following the Great Depression, the United States did not have a single financial crisis. However, the progressive deregulation of the financial sector since the 1980s gave rise to an increasingly criminal industry, whose “innovations” have produced a succession of financial crises. Each crisis has been worse than the last; and yet, due to the industry’s increasing wealth and power, each crisis has seen few people go to prison. In the case of this crisis, nobody has gone to prison, despite fraud that caused trillions of dollars in losses. I hope that the film, in less than two hours, will enable everyone to understand the fundamental nature and causes of this problem. It is also my hope that, whatever political opinions individual viewers may have, that after seeing this film we can all agree on the importance of restoring honesty and stability to our financial system, and of holding accountable those to destroyed it.”

43 people who appear in this film

- William Ackman—Managing partner, founder, and CEO of hedge fund Pershing Square Capital Management. He is known as an activist investor whose 2007 presentation “Who Is Holding the Bag?” was one of the first warnings about the impending crisis.

- Daniel Alpert—Founding Managing Director of Westwood Capital with more than 30 years of investment banking experience, and a frequent commentator on economic policy and financial regulation.

- Jonathan Alpert—Jonathan Alpert is a Manhattan psychotherapist and advice columnist. He has a full time practice where he sees, among others, Wall Street executives, professionals, and women who formerly worked as escorts and prostitutes.

- Sigridur Benediktsdottir—Yale economics lecturer who was tapped by the Icelandic government following the collapse of their banking system to be one of the three members of the Icelandic Parliament’s Special Investigation Commission analyzing the causes and consequences of Iceland’s financial and banking crisis. The Commission recently issued a 2,000 page report. Partly as a result of the Commission’s investigation, several of Iceland’s senior banking and investment group executives are now facing prosecution and/or lawsuits. Jon Asgeir Johannesson, the former investment group executive featured in the film, recently had his assets frozen by British courts as the result of a lawsuit filed by the new management of Glitnir bank.

- Willem Buiter—Chief economist for Citigroup. Prior to this appointment, Buiter was professor of European Political Economy, London School of Economics and Political Science; former chief economist of the European Bank for Reconstruction and Development (EBRD), former external member of the Monetary Policy Committee (MPC); advisor to international organizations, governments, central banks and private financial institutions. He has been published widely on subjects including open economy macroeconomics, monetary and exchange rate theory, fiscal policy, social security, economic development and transition economies. His Mavercon blog ran on FT.com until December 2009.

- John Campbell—Department chair of Harvard University’s Department of Economics. Campbell has received various honors including President, American Finance Association, 2006; Fellow, American Academy of Arts and Sciences, 2000-present; Fellow, Econometric Society, 1990–present, Honorary Fellow, Corpus Christi College, University of Oxford, 2008.

- Patrick Daniel—Former director of Ministry of Trade and Industry for Singapore government’s Administrative Service. Named editor-in-chief of the English and Malay Newspaper Division of Singapore Press Holdings in 2007, is chairman of three SPH subsidiaries and is president of the Singapore Press Club.

- Satyajit Das—Das is a former trader who worked for CitiGroup and Merrill Lynch as well as a former corporate Treasurer. He is a global authority on, and author of several key reference works on, derivatives and risk management. He is the author of Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives—Revised Edition (2006 and 2010, FT-Prentice Hall), an insider’s account of the financial products business filled with black humor and satire, described by the Financial Times, London as “fascinating reading… explaining not only the high-minded theory behind the business and its various products but the sometimes sordid reality of the industry.” In the 2006 book and in subsequent public speeches and articles published before the crisis, he pointed out the dangers of derivatives and financial products and the risk they constituted to the financial system.

- Kristin Davis—Best known as the “Madam” to countless investment bankers, Davis was convicted of promoting prostitution and served 4 months on Riker’s Island.

- Martin Feldstein—The George F. Baker Professor of Economics at Harvard University and President Emeritus of the National Bureau of Economic Research where he served as President and CEO from 1977-1982 and 1984-2008. He was chairman of the Council of Economic Advisors in the Reagan Administration. Under George W. Bush’s administration, he was appointed to the President’s Foreign Intelligence Advisory Board. He served on the board of both AIG and AIG Financial Products from 1988-2009.

- Jerome Fons—Served as Managing Director of Credit Policy at Moody’s Investor Services, where he was also a member of the Credit Policy Committee. He is currently a consultant specializing in credit risk applications and litigation support.

- Barney Frank—Democratic Representative for the state of Massachusetts who has served in the 4th congressional district since 1981. Frank became the Chairman of the House Financial Services Committee in 2007 which oversees the entire financial services industry including the securities, insurance, banking, and housing industries.

- Robert Gnaizda—General Counsel, Policy Director, and former President of the Greenlining Institute in Berkeley, California. A graduate of Columbia College and Yale Law School, he has been known as an advocate of social justice for over 40 years.

- Michael Greenberger—Since July 2001, Michael Greenberger has been a professor at the University of Maryland School of Law where he teaches a course entitled “Futures, Options and Derivatives.” He serves as the technical advisor to the Commission of Experts of the President of the United Nations General Assembly on Reforms of the International Monetary and Financial System. He was a partner for more than 20 years in the Washington, D.C. law firm, Shea & Gardner, where he served as lead litigation counsel before courts of law nationwide, including the United States Supreme Court. In the Clinton Administration, Greenberger was Director of Trading & Markets for the Commodity Futures Trading Commission, reporting to its Chairwoman, Brooksley Born, when Born attempted to regulate derivatives.

- Alan Greenspan—former U.S. Federal Reserve chair- man

- Eric Halperin—Special Counsel for Fair Lending at the U.S. Department of Justice and former director of the Washington Office and Litigation at Center for Responsible Lending.

- Samuel Hayes—Hayes holds the Jacob H. Schiff Chair in Investment Banking Emeritus at the Harvard Business School. He has taught at Harvard since 1970, prior to which he was a tenured member of the faculty at Columbia University Graduate School of Business. His research has focused on the capital markets and on the corporate interface with the securities markets. He has consulted for a number of corporations, financial institutions and government agencies, including the Justice Department, the Treasury Department, the FTC and the SEC, where he served on the Tully Commission in 1994-1995 to examine the compensation arrangements for stock brokers.

- Glenn Hubbard—Chief Economic Advisor during the Bush Administration and current Dean of the Columbia University Business School. A supply-side economist, Hubbard was instrumental in the design of the 2003 Bush Tax cuts. The design was heavily opposed by economists. Hubbard is on the board of Met Life, was previously on the board of Capmark, and has consulted to many financial services firms. He has written many articles advocating deregulation of financial services.

- Simon Johnson—An expert on financial and economic crises, Johnson is the Ronald A. Kurtz Professor of Entrepreneurship at the MIT Sloan School of Management and a senior fellow at the Peterson Institute for International Economics in Washington DC. From March 2007 to August 2008, he was Chief Economist at the International Monetary Fund (IMF). He is co-author of the book 13 Bankers: The Wall Street Takeover and The Next Financial Meltdown and a co-founder of baselinescenario.com.

- Christine Lagarde—The French Minister of Finance, Economic Affairs, Industry and Employment. She has also served as France’s Minister of Agriculture and Fishing, as well as Trade Minister. She was the first woman to ever become the Economic Minister of a G8 nation.

- Jeffrey Lane—CEO of Modern Bank, and former Chairman and CEO of Bear Stearns Asset Management. Former VP of Lehman Brothers, a member of the Office of the Chairman, Co-Chairman of Lehman Brothers Asset Management and Alternatives Division, and Chairman and CEO of Neuberger Berman, Inc.

- Andrew Lo—Harris & Harris Group Professor of Finance at the MIT Sloan School of Management and the director of MIT’s Laboratory for Financial Engineering. He is the author of Hedge Funds: An Analytic Perspective and co-author of The Econometrics of Financial Markets and A Non-Random Walk Down Wall Street.

- Lee Hsien Loong—The current Prime Minister of Singapore, a position he has held since 2004. Previously, he was the Chairman of the Monetary Reserve of Singapore and he also served as Deputy Prime Minister, Minister of Trade and Industry, and Minister of Finance.

- Andri Magnason—An Icelandic filmmaker and the author of Dreamland: A Self-Help Manual for a Frightened Nation, and producer of “Dreamland,” a documentary about Iceland’s environmental and financial problems.

- David McCormick—Former Under Secretary for International Affairs at the U.S. Department of Treasury from 2007-2009. Prior to that, he served as Deputy National Security Advisor to the President for International Economic Affairs. Before that, he had been the Under Secretary of Commerce for Industry and Security, and he is currently on the faculty of Carnegie Mellon’s Heinz College as a Distinguished Service Professor of Information Technology, Public Policy and Management at the Washington, DC campus. He graduated from West Point, served in the first Gulf War, and then became a software executive before entering government.

- Lawrence McDonald—McDonald is a co-writer of A Colossal Failure of Common Sense, a book on the fall of Lehman Brothers. From 2004 to 2008, McDonald served as Vice President of Distressed Debt and Convertible Securities Trading at Lehman Brothers.

- Harvey Miller—Called “the most prominent bankruptcy lawyer in the nation” by the New York Times, Miller is a partner at Weil, Gotshal and Manges, LLC, where he created the firm’s Business Finance and Restructuring Department specializing in distressed business entities.

- Frederic Mishkin—American economist and professor at Columbia Business School, Mishkin was a member of the Board of Governors at the Federal Reserve from 2006 to 2008. In 2006, he was paid $124,000 by the Icelandic Chamber of Commerce to write a report praising Iceland’s financial sector.

- Charles Morris—Author of The Trillion Dollar Meltdown: Easy Money, High Rollers and the Great Credit Crash, which analyzes the sub-prime mortgage crisis and the economy as a whole. He was the one of the people who predicted the crisis before it happened.

- Frank Partnoy—Professor of Law at the University of San Diego specializing in corporate law, corporate finance and financial market regulation. Partnoy previously worked as an investment banker at Credit Suisse First Boston and Morgan Stanley. He is the author of The Match King: The Financial Genius Behind a Century of Wall Street Scandals.

- Raghuram Rajan—An economist and Eric J. Gleacher Distinguished Service Professor of Finance at the Booth School of Business, University of Chicago. In 2005, while serving as chief economist of the International Monetary Fund (IMF), he delivered a controversial paper criticizing the financial sector entitled “Has Financial Development Made the World Riskier” which argued that disaster loomed. The paper, which proved accurate, was aggressively criticized by Larry Summers, then the president of Harvard, and currently director of the National Economic Council in the Obama Administration.

- Kenneth Rogoff—Thomas D. Cabot Professor of Public Policy and Professor of Economics at Harvard University and the co-author of Foundations of International Macroeconomics. Rogoff has previously worked as Economic Counselor and Director of the Research Department of the International Monetary Fund and served as an economist on the Board of Governors of the Federal Reserve System.

- Nouriel Roubini—Professor of Economics at the Stern School of Business at New York University and chairman of Roubini Global Economics, an economic consultancy firm. Once called “Dr. Doom” by The New York Times, Roubini first predicted the forthcoming economic crisis back in 2006. He is the author of Crisis Economics, an analysis of the global financial crisis.

- Andrew Sheng—Chief Advisor to the China Banking Regulatory Commission. He was the former Deputy Chief Executive responsible for both the Reserves Management and External Affairs Departments at the Hong Kong Monetary Authority. He also worked at senior levels in the World Bank.

- Allan Sloan—Journalist who wrote for Fortune Magazine about the market, the crisis, and the wrongdoing that led to the financial crisis.

- George Soros—is a Hungarian-American currency speculator, stock investor, businessman, philanthropist, and progressive liberal political activist. He became known as “the man who broke the bank of England” after he made a reported $1 billion during the 1992 Black Wednesday UK currency crisis. He is a founder and chair of the Open Society Institute / Soros Foundation.

- Eliot Spitzer—Lawyer and former politician. He served as the 54th Governor of New York (Democrat) from January 2007 until his resignation on March 17, 2008. Prior to being elected governor, Spitzer served as New York State Attorney General. While serving as attorney general, Spitzer initiated a series of major lawsuits against all of the major U.S. investment banks, alleging fraud in their handling of stock recommendations, which resulted in settlements totaling $1.4 billion.

- Dominique Strauss-Kahn—Current Managing Director of the International Monetary Fund and former Minister for Finance, Economy and Industry, France.

- Scott Talbott—Top lobbyist for the Financial Services Roundtable. The Roundtable lobbies on behalf of 100 of the top banks, credit card companies, insurance and securities firms operating in the U.S. Its membership includes many bailed-out banks including Citigroup, JP Morgan Chase, Bank of America, Wells Fargo and PNC.

- Gillian Tett—British and award-winning journalist at the Financial Times, where she is the U.S. managing editor. She is the author of Fool’s Gold, which traced the development of the CDO market and its role in the financial crisis.

- Paul Volcker—An American economist who served as Chairman of the Federal Reserve under Presidents Carter and Reagan from 1979-1987. He currently serves as Chairman of the Economic Recovery Advisory Board under President Obama.

- Martin Wolf—Associate Editor and Chief Economics Commentator at the Financial Times.

- Gylfi Zoega—Faculty Chairman of the Department of Economics at the University of Iceland.

The Wall Street culture that this movie details is enough to make any Christian pause and wonder why God allows this country to prosper. This is not a perfect nonpartisan account, as I noticed a liberal undertone, but it’s certainly more politically neutral than I would have expected. One of the glaring omissions was Barney Franks involvement. He should have been grilled as hard as the other government officials for his egregious involvement in this “Inside Job”.

Unfortunately, this movie won’t likely be on the top of people’s “must see” lists. There are no great battles, car chases, or drama. It instead requires an amount of attention that I fear most movie audiences just aren’t ready to give—Which is a travesty, because I think everyone needs to see just how deeply corrupt our “Wall Street Washington” has become.

My Ratings: Moral rating: Better than Average / Moviemaking quality: 5